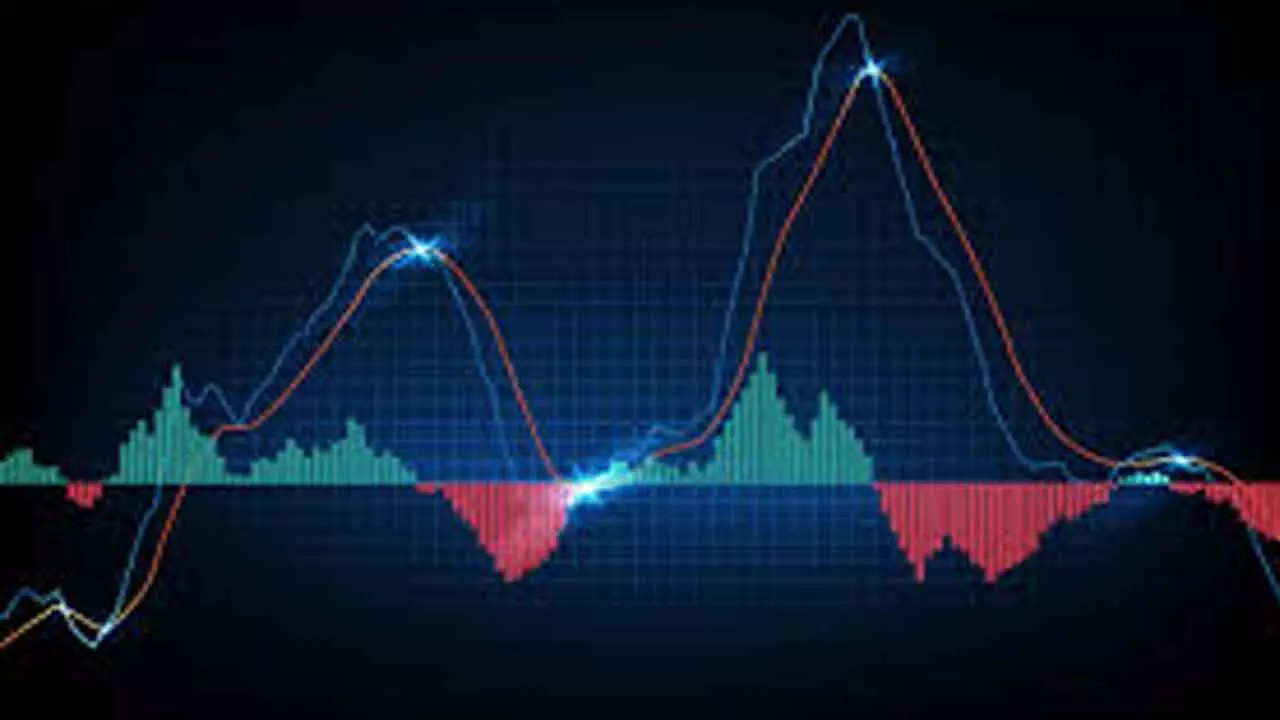

Weekly MACD Signalling Bearish Bias

A move above the 23,538 will result in the Double Bottom pattern breakout; So, it is better to wait to watch the price action for the next 2 weeks

Weekly MACD Signalling Bearish Bias

The equities declined sharply with the resumption of the selling pressure. The large-cap stocks declined the most. NSE Nifty declined by 321.11 points or 1.31 per cent and closed at 23,954.55 points. The Midcap and Smallcap indices closed positive. The PSU Bank index is the top gainer with 0.93 per cent. The Media and Realty also closed with moderate gains. The Nifty IT is the top loser with 2.39 per cent. The Auto, Services, Infra, and Private Sector Bank index declined by over a per centage points. All other sector indices ended with a decline. The India VIX is up by 3.97 per cent to 15.20. The market breadth is positive as 1,537 advances and 1,245 declines. About 61 stocks hit a new 52-week high, and 118 stocks traded in the upper circuit. Adani Enterprise, Adani Power, HDFC Bank, ICICI Bank, and NTPC Green were the top trading counters today in terms of value.

The Nifty sharply declined again and filled the Monday’s gap area. It registered a distribution day. This session’s volumes were the highest this week. It formed a lower high and lower low candle and also declined below the 20DMA. After three days of tight range, the index registered a decisive breakdown. Heavyweight stocks like Infosys, HDFC Bank, Reliance, ICICI Bank, and TCS dragged the index.

The Nifty failed to move above the prior swing high 24,538 points and formed a lower swing high. As stated earlier, the current swing is limited to two days of massive move. After two days of a huge rally of 1,088 points, it consolidated within the tight range. The Flattened 20DMA was again turned down. It closed below 38.2 per cent retracement level for the last five days. As the index registered a big negative day after November 13 and closed below the crucial support levels, we can assume that it has resumed its downside move. Only in the case of a close above the Wednesday’s day high of 24,354 points, is positive.

The RSI is back to the 45 zone. The MACD shows a sharp decline in bullish momentum. The weekly MACD is about to give a bearish signal. The RSI must take support at 60 on a monthly time frame. Otherwise, will enter into a further strong bearish trend. The immediate support is at 200DMA of 23,639 and the 200EMA of 23,566 points. The index may test this support zone next week. If the index breaks below the prior low of 23,263 level, is a confirmation of a resumption of a downtrend. If the index is able to bounce from the 200DMA or EMA, it will form a higher low. Then, a move above the 23,538 points will result in the Double Bottom pattern breakout. So, it is better to wait to watch the price action for the next two weeks.